|

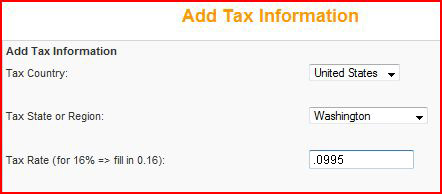

To set up your site’s sales tax, go to Shopping Cart >> Tax >> List Tax Rates |

|

Here you can edit the current tax, or create a new tax for your state if there is no tax created. Click the red “USA” or the red tax rate value, then enter the new rate. Your tax rate is a percentage expressed with a decimal point (i.e. if your state has a tax rate of 9.95% you would enter .0995) Now when a shopper selects the state that they will be shipping to, the appropriate tax will be applied.

|

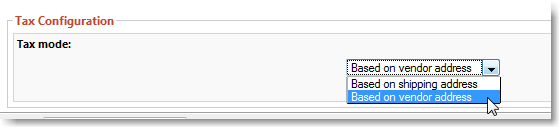

If you need to collect taxes for shipping out-of-stateUsually, out of state purchases do not require you to charge tax. If you do need to charge your local tax on items shipped out of state, you can do that in Shopping Cart > Configuration > Tax Configuration

Go to Tax Mode, and choose “Based on vendor address” instead of “Based on shipping address.” If you need to collect the shopper’s local tax on out-of-state sales, you can set up tax rates for every state. Put in a support ticket for help on this. |

|

Marking Items as Non-TaxedFor items in your cart that you do not want taxes applied to (e.g. Gift Certificates), go to the product details page (Shopping Cart >> Products >> List Products), open the details for the product in question, and select the check box to Disable tax.

|

*Specialty Toys Network does not intend this or any other support service statements to be interpreted as advise on how you should collect any required taxes. The collection and payment of any and all required taxes is the sole responsibility of the Store Owner(s). |